Before you search for specific MPNs, it’s useful to understand broad trends in electronic component pricing and availability to save time and money. At Octopart, we manage information of more than 40 million electronic parts, so we are uniquely positioned to aggregate the part data information and find interesting pricing trends. Electronic data is complex —every part typically is offered by multiple distributors with different quantities in stock and pricing at different price breaks — but if we aggregate all these sources, we can see that interesting trends appear. Recently, we made a couple of feature updates that now make finding component trends easier, so we can finally dig deeper into big picture questions that can help people make better decisions when it comes to buying parts they need:

a. Median pricing to compare pricing between parts:

Any part has multiple offers from distributors, each with their own pricing and price break information. Earlier this year, we introduced median pricing in search results for every part at a quantity of 1000 to make it easier to compare pricing between parts with similar attributes or get a big-picture idea of the general pricing in the market.

In order to find the central price point of a part family, we calculated the median price for every part in that family and then chose the middle value among them. Important: The middle value is useful to get a “general” understanding about a part family, and is in no way reflective of the pricing for a single part. It’s important to keep in mind that if parts from a manufacturer are only available from a single inexpensive distributor they will be priced low in median-of-medians, and if we have another manufacturer with similar pricing from that distributor, but another higher-priced distributor, that will drag the medians up.

b. An expanded set of filter values:

While the median price is a good way to get an overall sense of a part’s price point, we also need to be able to see how pricing changes with different filter values in order to understand relationships between them. How does price change with output current for regulators? How does price change with memory for MCUs? We recently launched an expanded set of filter values for every part. The combination of median pricing and our expanded set of filters now allows us to answer these questions and look for overall trends in Octopart data.

Let’s start answering the questions!

1. Which resistor size is generally the cheapest?

To answer this question, we’ll take some popular chip SMD resistor families (chosen from our blog, “How to Select a Resistor”) and see how pricing changes with size. The chart below shows the prices for 1,000 resistors at size 0402, 0603, 0805 and 1206. The three part families are from the Vishay CRCW series, Yageo RC series, and the Panasonic ERJ series. As we can see, different part families follow similar trends in pricing. I expected 1206 to be the most expensive because it is the largest, but 0603 is not the smallest size, yet is the cheapest. This could be a reflection of its popularity.

2. How does price change with memory for microcontrollers?

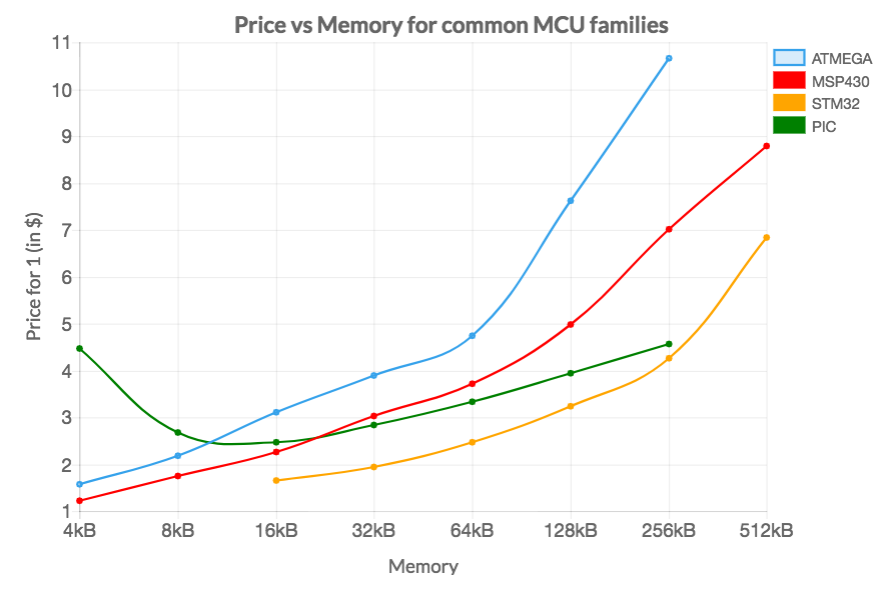

To answer this question, we will look at a chart of prices vs. memory for some common MCU families (chosen from the CPL). The blue line represents MCUs from ATMEGA family, the red line represents MSP430 family, the orange line represents STM32 family, and the green line represents PIC family.

As we can see, pricing increases linearly up to a certain memory size - for ATMEGA and MSP430 families it is around 64kB, for STM32 family it is around 128kB. After this memory size, there is an exponential increase in price. For ATMEGA microcontrollers. it costs 1.2x to move from 32kB memory to 64kB memory but it costs 1.6x to move from 64kB to 128kB memory. It’s important to remember that this information is based on medians, which can vary based on how many distributors send us pricing information on these parts, not just their pricing — if parts from a manufacturer are only available from a single inexpensive distributor they will be priced low in median-of-medians, and if another manufacturer with similar pricing from that distributor, but another higher-priced distributor, that will drag the medians up.

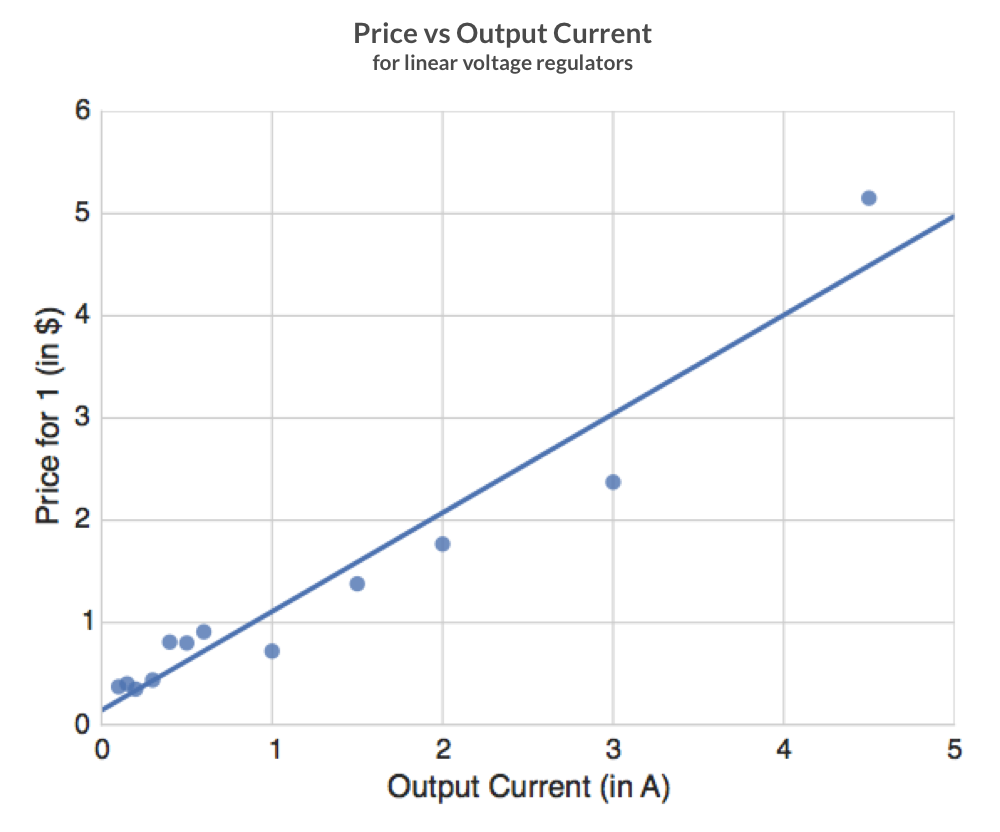

3. How much current can you get in linear regulators by spending $1? $2?:

To answer this question, we plotted pricing vs. output current for all linear voltage regulators. The chart below shows the linear relationship between price and output current. As expected, there is a proportional relationship between price and output current, but interestingly, the relationship is quite linear, so we can expect to get around 1A for $1 and 2A for $2.

We made this same chart for switching regulators too, but the relationship between pricing and output current wasn’t linear. Perhaps due to the higher number of factors that go into choosing a switching regulator such as frequency, feedback control, and the size of components.

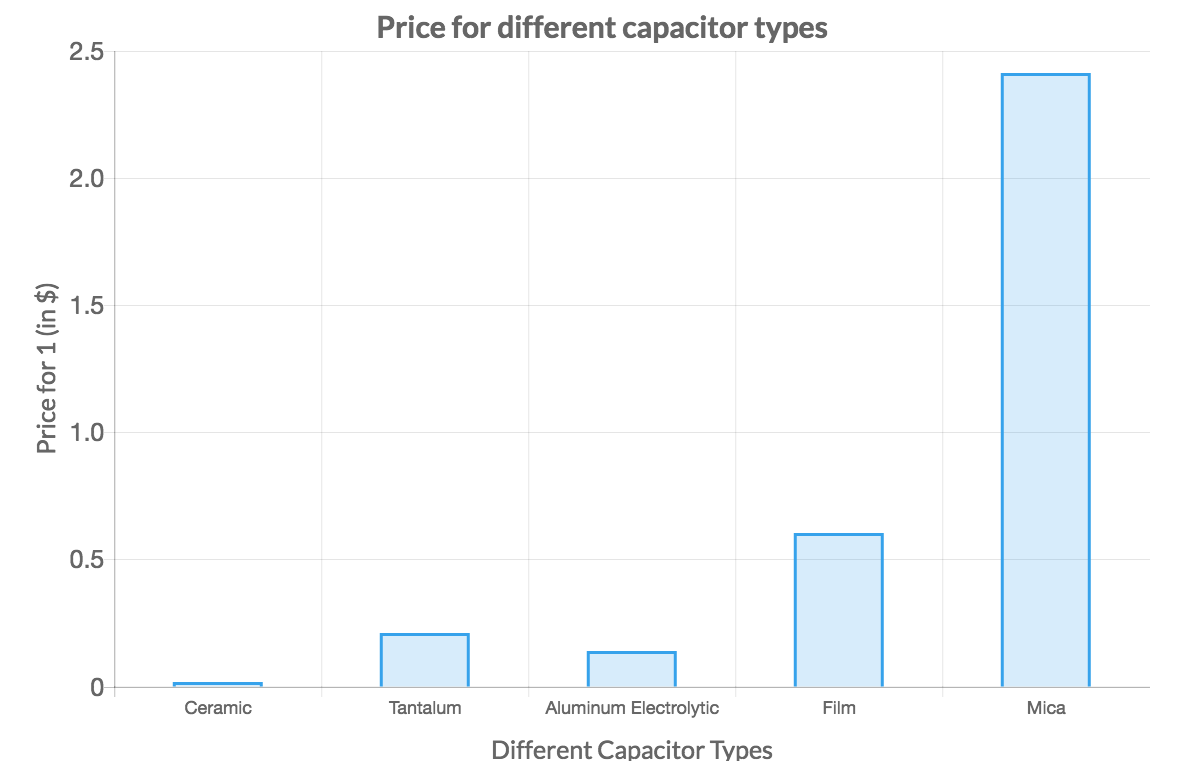

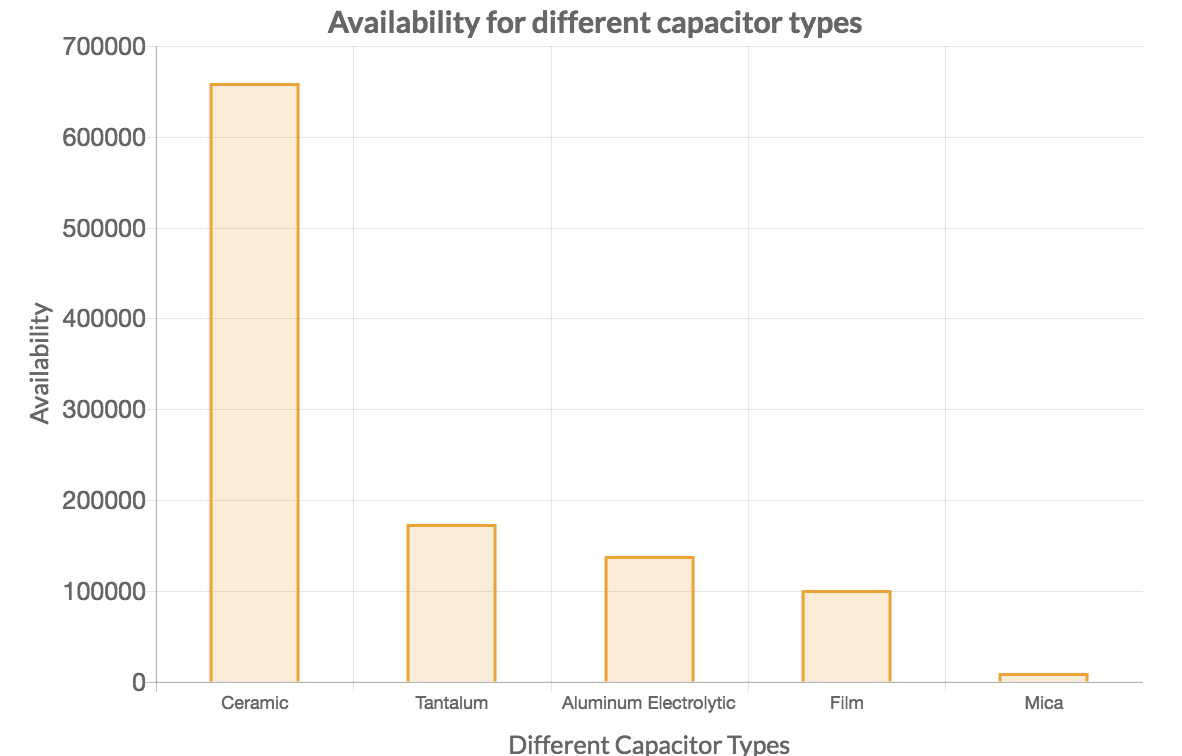

4. Which capacitor type is cheapest? Which is most available?:

To answer this question, we plotted availability for ceramic, tantalum, aluminum electrolytic, film, and mica capacitors, and then found the price of a common part family in each capacitor type (chosen from our blog, “How to Select a Capacitor”). For pricing, we chose Yageo’s CC series for ceramic caps, TAJB series for tantalum caps, ECA series for electrolytic caps, B32 series for film caps and MC series.

In the charts below, we can see an inverse relationship between pricing and availability for the capacitor types. Ceramic capacitors are the cheapest and most widely available. Mica capacitors are most expensive and least available. This is expected as ceramic capacitors are widely used in PCB applications as they are non-polarized and have small sizes. Mica capacitors, on the other hand, are used in speciality high-frequency applications such as RF transmitters and are not very common.

In the visualizations above, we dug deep into Octopart data and found some interesting pricing trends. We learned that 0603 resistors are cheapest, we found how pricing increases exponentially with memory for MCUs after a certain memory size, we saw the linear relationship between price and output current for linear regulators, and finally saw an inverse relationship between pricing and availability for different capacitor types.

Let us know what you thought of these visualizations. Do let us know what other visualizations might be appealing to you? You can drop a comment below or chat with us in our Slack room!